Since April 18, 2023, the total value locked (TVL) in decentralized finance (defi) has been fluctuating just below the $50 billion threshold. As of today, the TVL amounts to $49.31 billion, registering a 1% increase within the last 24 hours.

TVL in Defi Shows Signs of Improvement, Yet to Surpass Previous Record of $53 Billion

Currently, the combined TVL across all defi platforms stands at $49.31 billion as of May 6, 2023, with Lido Finance leading the pack by commanding a 24.82% share of $12.24 billion on Saturday. Over the past month, Lido’s TVL has grown by 9%, while posting a moderate 2.42% increase in the preceding week. The remaining top five candidates in today’s defi landscape include Makerdao, Aave, Curve Finance, and Uniswap; three out of these four experienced monthly downturns, with Uniswap being the exception by posting a 3.48% gain over the past 30 days.

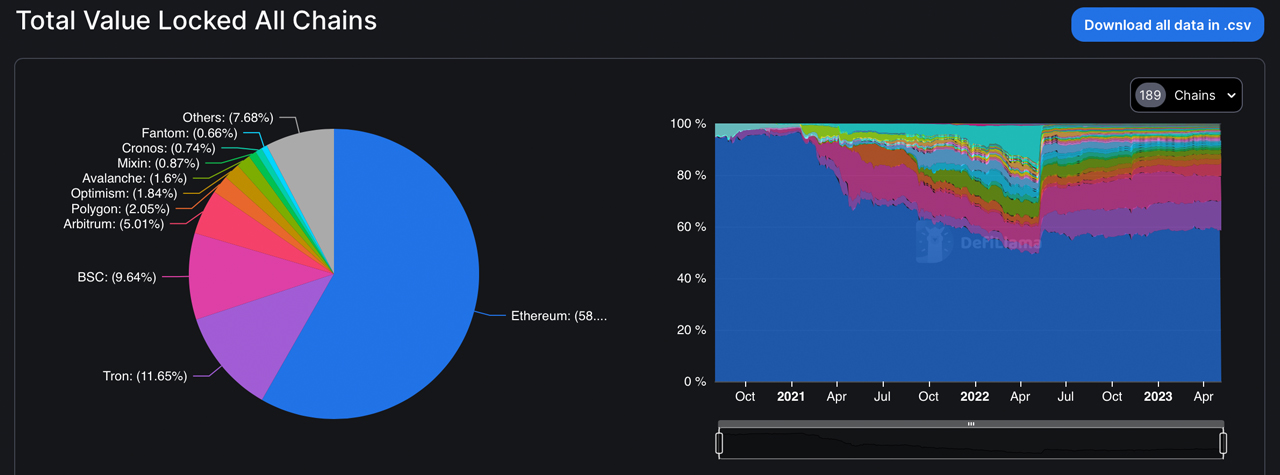

Ethereum takes the lion’s share of this TVL with its $28.66 billion accounting for over 58% of the defi market cap. Following Ethereum are other contenders such as Tron, BSC, Arbitrum, and Polygon who boast relatively large TVL statistics. Both Tron and Arbitrum have recorded monthly gains of 7.77% and 9.98%, respectively. However, BSC stands as the top defi-chain loser in terms of TVL losses from last month with a decrease of approximately 6.52%.

A sizable $16.416 billion worth of ETH (8,550,940 ETH) is locked in liquid staking platforms out of the entire $49.31 billion amount locked in defi systems today. The dominant liquid staking platforms for Ethereum are Lido, Coinbase, Rocket Pool, Frax, and Stakewise. Rocket Pool and Frax have witnessed impressive 30-day increases of 29.75% and 39.49%, respectively. Furthermore, the largest number of defi applications belongs to Ethereum with 771 protocols in total.

While Binance Smart Chain and Polygon follow Ethereum’s protocol count with 593 and 409 applications, respectively, Tron — the second-biggest defi blockchain — has only 18 associated protocols. However, Tron boasts the highest user base among the top five defi platforms with 2,538,896 participants. Ethereum’s active user count for its defi apps is approximately 332,548. Although the TVL in defi has shown signs of improvement in 2023, it has yet to surpass its previous record of $53 billion.

What are your thoughts on the current state of the defi market? Do you think it will continue to grow and surpass its previous record, or will it face challenges in the coming months? Share your insights in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer