The price of bitcoin tapped a new low this year hitting $34K per unit at just after 5 a.m. (EST) on Saturday morning. Bitcoin is now down over 48% lower than its all-time high (ATH) reached two months ago on November 10, 2021 — when it jumped above the $69K mark. During the last week alone, bitcoin has lost 17% in value and a great number of traders and investors are curious as to when the carnage is going to end.

Digital Currency Market Carnage Continues, Crypto Economy Drops to $1.75 Trillion

It’s been a blood bath in the world of cryptocurrencies this week, as bitcoin’s (BTC) price has dragged every coin down with it. Today, the entire crypto-economy has lost 11% in the last 24 hours. BTC has been on a downtrend since the crypto asset’s ATH, and since December 27, 2021, back when BTC was trading for $52K, bitcoin has lost more than 32% in value against the U.S. dollar.

Just after 5 a.m. (EST) on Saturday morning, BTC’s value dropped to its lowest point of the year so far, tapping $34,000 per unit. The leading crypto asset’s 24-hour range has been between $39,177 and 34,000 per BTC. While BTC has dropped in value a great deal during the last 48 hours from $43,400 to the current $35.5K to $36K per unit, BTC dominance has increased significantly.

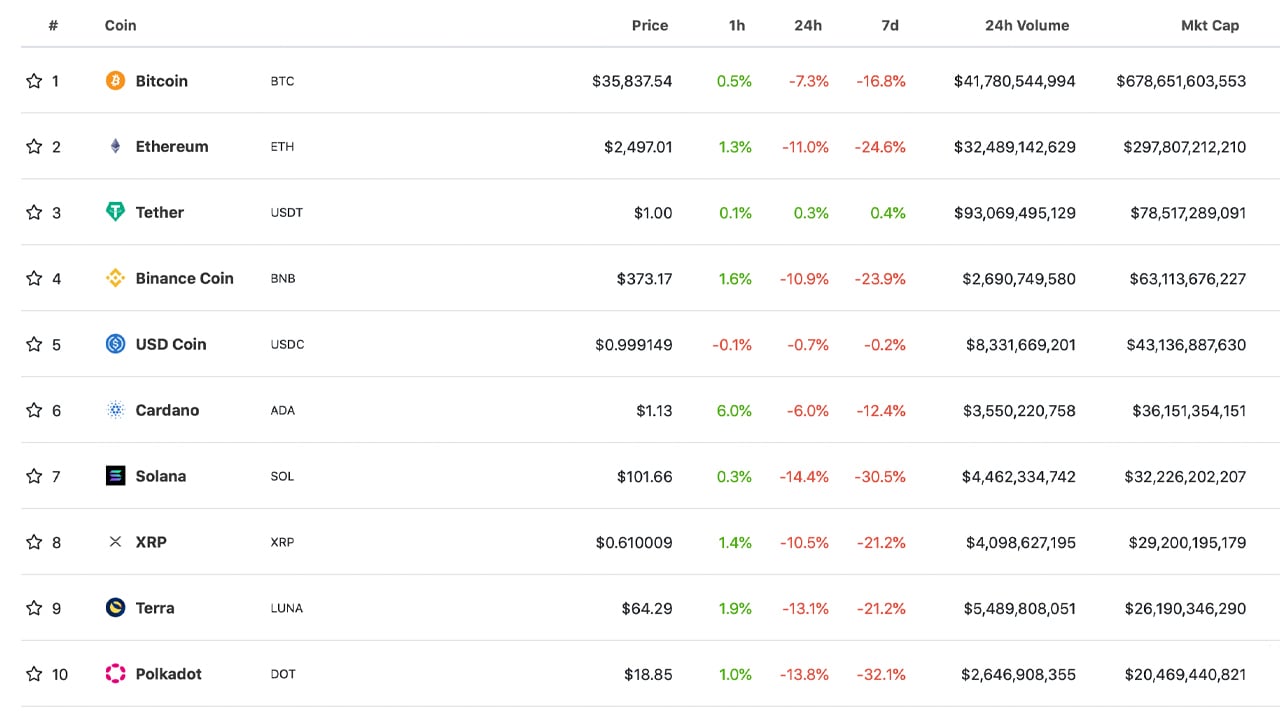

At the time of writing, BTC’s market dominance is 39.5% which is 5.33% higher than it was on January 6, 2022. Ethereum dominance, on the other hand, has dropped to 17% and a myriad of other crypto assets shed lots of dominance percentages as well. Out of the top ten crypto assets, polkadot (DOT) shed the most during the week, losing 32.1%.

Furthermore, solana (SOL) is down 30.5% in seven days, and ethereum (ETH) has dropped by 24.6% since last week. BNB is down 23.9% and xrp (XRP) and terra (LUNA) are both down 21.2% over the last seven days. BTC and ADA saw the least amount of percentage losses this week as ADA shed 12.4% and BTC dropped 16.8%.

The crypto economy has shed quite a bit of value this past week, and it has a lot of people talking about the crash on social media. Vertical trends on Twitter indicate hashtags like #cryptocrash and #bitcoincrash are trending alongside discussions about Michael Saylor and Microstrategy’s bitcoin stash. People have been wondering whether or not Saylor and Microstrategy will sell their BTC holdings and people have questioned Tesla holding its bitcoin long term as well.

Meanwhile, most of the crypto supporters on Reddit forums and social media channels like Twitter, have no idea when the carnage is going to end. While a number of crypto advocates believe the bearish markets are almost over and new ATHs are on the horizon, others believe BTC could drop even further, below the $20K zone.

Youtuber Colin Talks Crypto tweeted that he believes the bull run is not over. “Bitcoin’s price has crashed enormously,” the crypto Youtuber wrote. “Many are fearful and panicking. This is understandable. Zoom out. We’re still up from the July 2021 drop to $29K. For me, the bull run isn’t over unless the bitcoin price is below $29,000 (and not just a momentary dip below it).”

What do you think about the recent bitcoin price plunge and how it dragged down the entire crypto-economy? Do you expect more bearish crypto prices or do you think the bull run is not entirely over? Let us know what you think about this subject in the comments section below.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or a recommendation or endorsement of any products, services, or companies. Bitcoin.com does not provide investment, tax, legal, or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on any content, goods or services mentioned in this article.

Read disclaimer